The Gramm-Leach-Bliley Act (GLBA) is a US federal law that was enacted in 1999 which requires financial institutions to ensure the privacy and security of their customers’ personal information. The law applies to a wide range of businesses, including banks, credit unions, security firms, insurance companies, and more.

Under the GLBA, businesses are required to:

- Implement safeguards: This protects the confidentiality, integrity, and availability of customers’ personal information. The law mandates that they provide their customers with privacy notices that explain their information-sharing practices and allow customers to opt-out of certain types of sharing.

- Develop a comprehensive written information security program (WISP): The WISP should include administrative, technical, and physical safeguards that are appropriate for the size and complexity of the institution which outlines their policies and procedures for protecting customer information.

- Ensure that service providers implement appropriate safeguards: Businesses must monitor and oversee their service providers to confirm that they are complying with the GLBA’s requirements to protect sensitive customer information.

The GLBA is enforced by several US federal agencies, including the Federal Trade Commission (FTC), the Office of the Comptroller of the Currency (OCC), and the Federal Reserve System. Financial institutions that fail to comply with the GLBA’s requirements may face significant fines and penalties, as well as damage to their reputation and customer trust.

How do User Access Reviews play a role in GLBA?

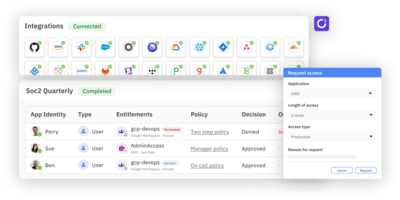

The purpose of UARs is to ensure that users have appropriate access privileges based on their job roles and responsibilities, and to detect and remediate any unauthorized access or segregation of duties conflicts, through regular review of user access.

GLBA’s requirements for privacy and security align with the goals of UARs. Financial institutions subject to GLBA must establish controls and procedures to protect customer information from unauthorized access. UARs play a crucial role in fulfilling these requirements by regularly assessing user access permissions, identifying any inappropriate access, and taking corrective actions to maintain the integrity and confidentiality of customer data.

UARs help financial institutions demonstrate compliance with GLBA requirements. By conducting regular access reviews and documenting the process, businesses can provide evidence of their efforts to ensure the appropriate use of customer information and mitigate the risk of data breaches or unauthorized access.

How does PAM play a role in GLBA?

Privileged Access Management (PAM) is a security practice that involves controlling and monitoring access to privileged accounts and services within an organization. PAM is important for businesses subject to the GLBA because it helps them meet the law’s requirements for protecting customer information and ensuring their network’s security.

PAM can help companies meet the GLBA’s requirement for a comprehensive written information security program (WISP). A key component of a WISP is policies and procedures created for controlling access to sensitive information. PAM can help implement these policies and procedures by providing tools for managing and auditing privileged access.

PAM is an important security practice that can help financial institutions meet the requirements of the GLBA by controlling and monitoring access to privileged accounts and services. By implementing PAM, financial institutions can enhance their security posture, protect customer information, and ensure compliance with regulatory requirements.

Why should I care about GLBA as an IT or Security professional?

From an IT and security perspective, GLBA imposes specific requirements and guidelines to protect customer data. Here are some key aspects of how GLBA relates to IT and security:

- Privacy and data protection: GLBA requires businesses to establish safeguards protecting the security and confidentiality of customer information. This includes implementing measures to prevent unauthorized access, ensuring secure storage and transmission of data, and developing incident response plans to address data breaches or security incidents.

- Risk assessment and management: Financial institutions must conduct regular risk assessments to identify and address vulnerabilities in their IT systems and data handling processes. This involves evaluating the potential risks to customer information and implementing appropriate security controls and countermeasures.

- Security policies and procedures: GLBA mandates financial institutions to develop and implement comprehensive security policies and procedures to protect customer data. These policies cover areas such as access controls, data encryption, network security, authentication mechanisms, and employee training on security practices.

- Third-party service providers: Financial institutions are responsible for ensuring that their third-party service providers, such as cloud providers or IT vendors, also comply with GLBA requirements. This includes performing due diligence assessments, establishing contractual agreements, and monitoring the security practices of these providers.

- Incident response and reporting: GLBA requires financial institutions to have incident response plans in place to promptly respond to and mitigate security incidents or data breaches. They must also notify customers and appropriate regulatory authorities in the event of a breach, taking necessary steps to rectify the situation and prevent future incidents.

By adhering to GLBA requirements, financial institutions can enhance the security and protection of customer data, mitigating the risks of unauthorized access, identity theft, or fraud. IT and security professionals play a crucial role in implementing and maintaining the necessary technical and procedural controls to ensure compliance with GLBA and safeguard customer information.

Summary

The GLBA is an important federal law that helps to protect the privacy and security of customer information held by financial institutions. UARs support and demonstrate compliance with GLBA by providing a mechanism to review and validate user access rights, ensuring that access privileges are appropriate and aligned with job roles. PAM helps businesses to achieve GLBA’s requirements through managing and auditing user access.

By implementing appropriate safeguards, such as UARs and PAM, as well as complying with the GLBA’s requirements, financial institutions can minimize the risk of data breaches and other types of cyber threats, while also enhancing customer trust and confidence.