SOX (Sarbanes-Oxley) compliance standards refer to a company’s adherence to financial controls and is generally applicable to public companies whereas SOC compliance standards provide a broad framework for ensuring data security, processing integrity, financial controls, and cybersecurity best practices for any service provider (such as a SaaS provider).

Both compliance frameworks provide a regulatory framework to ensure consistent financial reporting and financial data, protect sensitive data against data breaches, and protect systems against unauthorized access. Beyond that, there are very specific differences which we will explore in this glossary post.

What is SOX Compliance?

SOX (Sarbanes-Oxley) compliance standards refer to a company’s adherence to the regulations and requirements of the Sarbanes-Oxley Act of 2002 federal law. This act was introduced after numerous high-profile financial scandals in order to increase transparency and accountability in corporate governance and specifically to ensure the quality of financial statements provided to the public. The SOX Act established new requirements for public companies and firms, including provisions for attestations of financial reporting and internal access controls, and is enforced by the securities and exchange commission (SEC).

SOX compliance involves implementing measures to ensure that companies are following the guidelines set out in the act. This can include creating a code of ethics and/or internal controls to prevent fraud and implementing regular financial reporting processes to ensure accuracy and transparency. Compliance with SOX is mandatory for all publicly traded companies in the United States, and failure to comply can result in fines, legal action, and reputational damage. Regular SOX audits, conducted by independent external auditors, are crucial to verifying a company’s adherence to these requirements and maintaining investor confidence.

What is SOC Compliance?

SOC (System and Organization Controls) compliance refers to a set of standards and guidelines developed by the American Institute of Certified Public Accountants (AICPA) for evaluating the controls and processes of service organizations.

There various types of SOC compliance frameworks including:

SOC 1

SOC 1 compliance focuses on the internal controls over financial reporting (ICFR) of a service organization. This standard is designed to ensure that the service organization’s controls are suitably designed and operating effectively to prevent, or detect and correct, errors and misstatements in the financial reports.

SOC 2

SOC 2 compliance comprises a set of criteria to ensure that service providers securely manage data to protect the interests and privacy of their clients. SOC 2 compliance is based on five Trust Service Criteria (TSC):

- Security: Ensures that the system is protected against unauthorized access, both physical and logical.

- Availability: Confirms that the system is available for operation and use as committed or agreed upon.

- Processing Integrity: Ensures that system processing is complete, valid, accurate, timely, and authorized.

- Confidentiality: Addresses the protection of information designated as confidential.

- Privacy: Ensures that personal information is collected, used, retained, disclosed, and disposed of in conformity with the commitments in the entity’s privacy notice.

To achieve SOC 2 compliance, an organization must implement robust policies, procedures, and controls that align with these criteria. This often involves comprehensive risk management, access controls, encryption, monitoring, and incident response strategies.

SOC 3

SOC 3 compliance offers a general-use report on a service organization’s controls relevant to security, availability, processing integrity, confidentiality, and privacy. Unlike SOC 2 reports, which are detailed and restricted to specific stakeholders, SOC 3 reports are designed for public distribution. They provide a summary of the service organization’s system and the effectiveness of the controls without disclosing sensitive information. This makes SOC 3 reports an excellent tool for organizations to showcase their commitment to robust security practices and build trust with a wider audience, including customers and business partners.

Type 1 and Type 2

Each SOC certification allows for a Type 1 and Type 2 (sometimes denoted type i or type ii) certification (for example SOC 2 Type 2). A Type 1 certification evaluates the design of controls at a specific point in time, while Type 2 assesses both the design and operating effectiveness of controls over a period of time.

Auditing

To adhere to SOC standards, companies must undergo an audit by a third-party, independent auditor. The auditor evaluates the service organization’s controls and processes to determine if they meet the AICPA’s standards. Once the audit is complete, the auditor issues a SOC report outlining their findings and whether the service organization is SOC compliant. Auditors are generally CPAs who have expertise in information security, risk management, and internal audit control testing. SOC audits (such as a SOC 2 audit) may take place at a single point in time (for a SOC 2 type 1 certification) or on an on-going basis (for a SOC 2 type 2 certification).

Implementing SOX or SOC Compliance

Implementing SOX and SOC compliance requires a commitment from the company to develop and maintain comprehensive internal controls related to financial reporting, security, data access, business processes, and access controls. Implementing these controls takes time and resources, but achieving SOX and/or SOC compliance provides valuable assurance to stakeholders that the company is following best practices and/or meeting regulatory compliance. Ultimately, both of these frameworks are about providing assurance to external parties that a service provider is managing risk and financial controls effectively.

A note about security

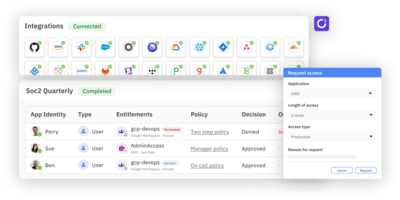

Both SOX and SOC compliance have several requirements for enforcing data security and access controls. Practices noted in both standards include:

- Birthright access should be minimal and focused on productivity-centric access

- An access control matrix should dictate who can access what

- Sensitive systems and permissions should be gated through requests and provisioned just in time

- Remove sensitive access once the justification is lost

- Periodically review sensitive accounts and access rights

Learn more about implementing access controls in our blog here.

Summary

SOX compliance refers to a business’s ability to follow the regulations and requirements of the Sarbanes-Oxley Act, while SOC 1, SOC 2, and SOC 3 compliance address a wider variety of business process integrity rules that span financial reporting, access governance, data security, and privacy. While SOX compliance is required for all public companies, SOC compliance may optionally be adopted by service providers as a best practice and to streamline doing business with third parties. Both frameworks require external auditing and verification and provide comprehensive audit reports that can be consumed.